Stripe

Churn

Failed payments

Gal C

Dec 7, 2025

Subscription businesses often focus on preventing customers from deliberately canceling their memberships. But there's a more insidious threat silently eroding revenue: involuntary churn from failed payments.

Understanding and measuring customer churn

There are two types of churn impacting your business:

Voluntary churn happens when a customer intentionally cancels their subscription.

Involuntary churn, sometimes called passive churn, occurs when a subscription lapses even though the subscriber didn’t mean to cancel—such as when a payment method on file expires.

In both cases, the lost customer means lost revenue. But the right strategies to reduce subscriber churn depend on the type of churn you want to tackle and how large of an issue it is

Involuntary churn

Unlike voluntary churn where customers intentionally cancel, involuntary churn occurs when subscriptions lapse despite customers wanting to continue—typically due to payment failures. According to new data from Stripe analyzing subscription transactions from September 2024 to August 2025, this "silent killer" represents a massive untapped opportunity for revenue recovery.

The Awareness Gap

The scale of the problem is staggering, yet many business leaders remain in the dark. 43% of business leaders admit they don't know how much revenue they've lost from involuntary churn or payment failure—though they want to find out. This lack of visibility means billions in potential revenue are slipping through the cracks unnoticed.

Why Payments Fail

Based on Stripe Billing data from 2024, payment failures happen for five main reasons:

Insufficient funds (most common)

Card declines from the issuing bank (second most common)

Expired credit cards

Changed billing details

Blocked payments

These are technical issues, not customer dissatisfaction—meaning they're often recoverable with the right intervention.

Involuntary Churn Rates: The Numbers Behind the Problem

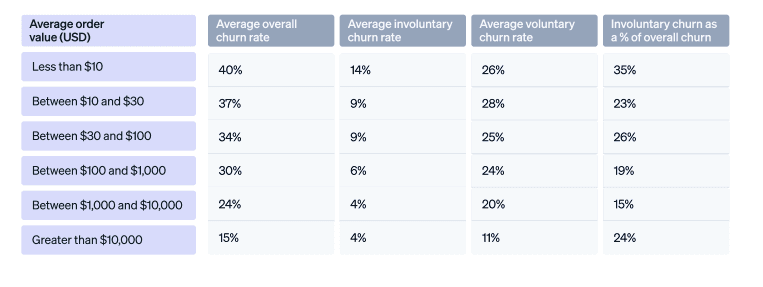

By Average Order Value

Involuntary churn rates decrease as subscription prices increase (from the Stripe churn report):

Less than $10: 14% involuntary churn rate

$10-$30: 9% involuntary churn rate

$30-$100: 9% involuntary churn rate

$100-$1,000: 6% involuntary churn rate

$1,000-$10,000: 4% involuntary churn rate

Greater than $10,000: 4% involuntary churn rate

Lower-priced subscriptions face higher involuntary churn, likely because customers using these services may have less reliable payment methods or tighter cash flow.

By Payment Method

The payment method customers use dramatically impacts involuntary churn rates:

Prepaid cards: 23% involuntary churn (highest risk)

Debit cards: 11% involuntary churn

Credit cards: 6% involuntary churn (lowest risk)

Prepaid cards are nearly 4x more likely to experience involuntary churn compared to credit cards, primarily due to insufficient funds.

By Business Model

B2C businesses: 9% involuntary churn rate

B2B businesses: 6% involuntary churn rate

B2C businesses face higher involuntary churn rates, likely due to consumers experiencing more payment issues like insufficient funds and card declines.

By Industry

Involuntary churn rates vary significantly across industries:

Furniture: 13%

Digital goods: 11%

Business services: 10%

Education: 10%

Personal services: 9%

Merchandise: 9%

SaaS: 8%

Travel and lodging: 8%

Leisure: 6%

Insurance: 3% (lowest)

The Composition of Total Churn

Involuntary churn represents a significant portion of overall customer churn:

Prepaid card users: 51% of their total churn is involuntary

Debit card users: 28% of total churn is involuntary

Credit card users: 18% of total churn is involuntary

B2C businesses: 24% of overall churn is involuntary

B2B businesses: 16% of overall churn is involuntary

For businesses where customers primarily use prepaid or debit cards, more than one in four churned customers didn't actually want to leave.

The Recovery Opportunity

Here's the critical insight: a monthly subscription that's recovered after a payment failure will continue for another seven months on average, according to Stripe data. This means recovering a single failed payment doesn't just save one month's revenue—it protects seven months of future subscription value.

In 2024 alone, Stripe's automated recovery features helped users recover $6.5 billion in revenue. This demonstrates the massive scale of recoverable revenue that exists across the subscription economy.

The Bottom Line

Involuntary churn from failed payments isn't a customer satisfaction problem—it's a technical and operational challenge with concrete solutions. For many subscription businesses, especially those with lower average order values or customers using debit and prepaid cards, involuntary churn could represent 20-50% of total churn.

The data is clear: businesses that implement effective payment recovery strategies can recapture billions in revenue that would otherwise be lost to technical payment failures. With 43% of business leaders admitting they don't even know how much they're losing, the first step is simply measuring the problem.

Data source: Stripe's "Benchmarks and churn management strategies for subscription businesses" guide, analyzing subscription transaction data from September 2024 to August 2025.Retry