Do not Honor

Insufficient funds

Stripe

Jake Vacovec

Dec 14, 2025

If you run a subscription business, you've seen it. A customer's payment fails with a "do not honor" decline code, and suddenly you're left wondering what went wrong and how to fix it. Unlike more specific decline codes that point to a clear issue, "do not honor" is frustratingly vague—it simply means the bank refused the transaction without telling you why.

For subscription businesses, this ambiguity is more than an inconvenience. Every failed payment that goes unrecovered is lost revenue, and "do not honor" declines account for a significant portion of involuntary churn. Understanding what triggers these declines and how to recover them is critical to protecting your MRR.

What Does "Do Not Honor" Actually Mean?

When a card issuer declines a transaction with a "do not honor" code, they're essentially saying "we're not approving this" without providing specifics. It's a catch-all decline code that can stem from multiple issues, and the only way to know the exact reason is for the cardholder to contact their bank.

This creates a recovery challenge. Without knowing the specific cause, you can't provide targeted guidance to your customers. Are they low on funds? Did the bank flag suspicious activity? Is there an account issue? You're left guessing, and your customers are left frustrated.

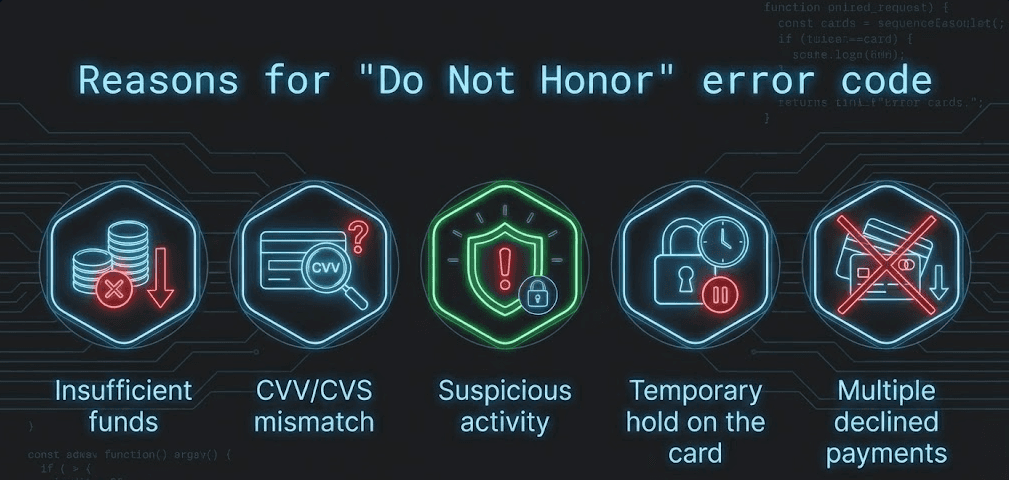

Why Cards Get Declined with "Do Not Honor"

The "do not honor" code can be triggered by several different scenarios. Here are the most common culprits for subscription businesses:

Insufficient Funds

This is the most frequent reason. Your customer's account doesn't have enough money to cover the subscription charge. For recurring payments, this often happens at the beginning of the month when multiple subscriptions renew at once, draining the account faster than expected. Debit cards are particularly vulnerable to this, since they draw directly from checking accounts with fluctuating balances.

Suspected Fraud or Unusual Activity

Banks use sophisticated fraud detection systems that monitor transaction patterns. If something looks off—like a customer traveling abroad and making a purchase in a new location, or unusual spending patterns—the bank may decline the transaction as a precaution. For subscription businesses, this can happen when customers change their billing address or when your business name doesn't match what the customer expects to see on their statement.

Daily Transaction Limits Exceeded

Most cards have daily spending limits. If your customer has made multiple high-value purchases in a single day, your subscription renewal might push them over the limit, resulting in a decline. Business credit cards often have higher limits, but consumer cards can be surprisingly restrictive.

Incorrect Card Details

Typos happen. An incorrect card number, expiration date, or CVV will trigger a decline. For subscription businesses, this is especially common when customers manually update their payment information or when saved card details become outdated after a card is reissued.

Account Issues

Sometimes the problem is with the card account itself. The card might have been closed, frozen, reported lost or stolen, or simply never activated. Card reissuances—when banks send new cards with new numbers and expiration dates—are a major source of "do not honor" declines for subscription businesses, since customers often don't update their payment information proactively.

The Hidden Cost of "Do Not Honor" Declines

For subscription businesses, payment declines aren't just technical errors—they're revenue leaks. Here's what happens when a "do not honor" decline goes unaddressed:

Immediate revenue loss: That month's subscription fee doesn't get collected

Increased churn risk: Customers whose payments fail are 3-4x more likely to cancel than those whose payments succeed

Customer experience degradation: Service interruptions frustrate customers and damage brand loyalty

Recovery overhead: Your team spends time on manual dunning emails and customer support

Compounding losses: The longer a payment stays failed, the less likely you are to recover it

Industry data shows that subscription businesses lose 5-10% of their MRR to failed payments, with "do not honor" declines representing a significant portion of these failures. For a company with $500K in MRR, that's $25K-$50K in at-risk revenue every month.

How to Reduce "Do Not Honor" Declines

While you can't prevent all declines, you can reduce their frequency and improve recovery rates:

Smart Retry Logic

Not all retries are created equal. Retrying a failed payment immediately is usually pointless, the same decline will occur. Smart retry logic waits for optimal windows (like after the customer's typical payday) and adjusts retry timing based on decline reason patterns. At FlyCode, our ML models analyze historical payment patterns to determine the best retry timing for each customer, typically improving recovery rates by 16-25%.

Better Card Data Collection

Requiring CVV and billing address during checkout reduces declines from incorrect card details. While it adds friction to signup, it significantly improves payment success rates for future renewals. Consider implementing address verification (AVS) and CVV checks, they're not just fraud prevention tools, they're decline reduction mechanisms.

Account Updater Services

Card networks offer account updater services that automatically refresh card details when cards are reissued. Stripe, for example, provides this through their platform. This prevents declines from expired cards before they happen, which is especially valuable for annual subscriptions where cards often expire between billing cycles.

Customer Communication

When a payment fails, your response matters. Generic dunning emails with vague instructions ("please update your payment method") don't work well. Specific, helpful communication that explains the issue and provides clear next steps dramatically improves recovery rates. For "do not honor" declines specifically, since you don't know the exact cause, provide multiple potential solutions and make updating payment information as frictionless as possible.

3D Secure Authentication

For high-value subscriptions or in markets where it's required (like the EU under PSD2), 3D Secure adds an authentication step that can reduce fraud-related declines. However, it also adds friction, so use it strategically based on your customer profile and regulatory requirements.

The FlyCode Approach to "Do Not Honor" Recovery

Generic dunning solutions treat all declines the same way. They send the same retry attempts and the same email templates regardless of decline type. This approach leaves significant revenue on the table, especially with ambiguous decline codes like "do not honor."

FlyCode takes a different approach. Our AI-powered recovery system analyzes hundreds of signals, from the specific decline code to historical payment patterns to customer behavior data, to create recovery models for each failed payment. For "do not honor" declines specifically:

Intelligent retry timing: We analyze when the decline is most likely to succeed based on historical patterns, rather than using generic retry schedules

Dynamic customer communication: Since we don't know the exact cause, we test different messaging approaches to see what drives the highest recovery rates for your specific customer base

Multi-channel recovery: We engage customers through email, in-app messaging, and other channels to maximize the chance they'll update their payment information

Automatic optimization: Our ML models continuously learn from recovery outcomes, getting better at predicting which strategies will work over time

The result? Our customers typically see 16-25% higher recovery rates compared to standard dunning solutions, with zero additional integration work required. We deploy alongside your existing Stripe or Shopify setup and start recovering revenue within days.

Measuring Recovery Performance

To optimize your payment recovery process, track these key metrics:

Decline rate by decline code: What percentage of your total declines are "do not honor" vs. other codes?

Recovery rate: What percentage of "do not honor" declines are eventually recovered?

Time to recovery: How long does it take to recover a failed payment?

Customer churn rate for failed payments: Are customers with failed payments churning at higher rates?

Recovery revenue: How much total revenue are you recovering from failed payments each month?

If your recovery rate for "do not honor" declines is below 40%, there's likely significant room for improvement. Top-performing subscription businesses recover 50-70% of failed payments, but this requires sophisticated retry logic and customer engagement strategies.

The Bottom Line

"Do not honor" decline codes are frustrating because they provide no clear path to resolution. But they're also an opportunity. Every failed payment you recover is revenue saved, churn prevented, and a customer relationship preserved.

For subscription businesses, the key is having a recovery system that can handle the ambiguity of "do not honor" declines intelligently—one that doesn't treat all failed payments the same, but instead adapts its approach based on what's most likely to work for each specific situation.

If you're losing 5-10% of your MRR to failed payments (and most subscription businesses are), it's worth examining whether your current recovery approach is capturing all the revenue it could. The difference between a 30% recovery rate and a 60% recovery rate can be hundreds of thousands of dollars annually for a growing subscription business.